There are a lot of metrics that you might use to determine how well your business is doing. But if you had to choose a single most important metric, what would it be?

Number of new customers? Average purchase size? Overall revenue? Web traffic?

All of those are important, but none are as critical as customer lifetime value (CLV).

Defining Customer Lifetime Value

Customer lifetime value is the amount of profit a company can expect to earn over the entirety of their business relationship with the average customer.

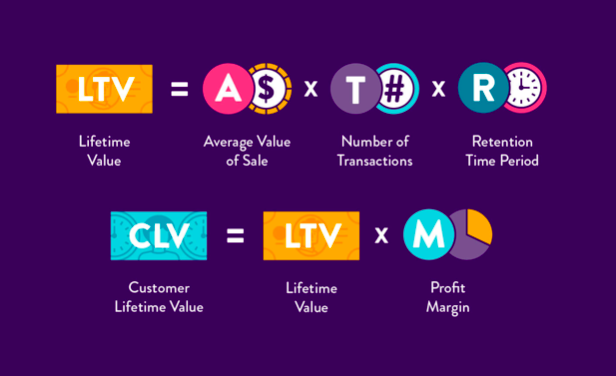

Let’s look at how to calculate lifetime value:

Lifetime value = average sale value x number of transactions x retention time period.

Customer lifetime value must also account for customer acquisition costs, marketing expenses, business operating expenses, and the cost of manufacturing the product and/or services.

Customer lifetime value = lifetime value x profit margin.

Image source: CleverTap.

Why Improving Customer Lifetime Value Is Crucial

You could make many arguments for why CLV is a better measure of the success of your sales and marketing teams, but it all comes down to this:

Customer lifetime value sums up the effects of many of your efforts in marketing and sales.

Think about it: your sales team has a direct effect on the average transaction value. As they improve, that number should go up. The number of transactions is affected by your sales team, account managers, and customer success reps. Retention is a big part of marketing. And everyone is concerned with profit margin.

Putting all of that together gives you your CLV. You won't know why your CLV has gone up just by looking at the number, but if it's risen, you'll know that your teams are doing their jobs well. If it goes down, someone's performance could use some work.

Of the factors that go into CLV, the retention period might be the most important. No matter the average transaction size, if people aren't sticking around to make a second purchase, you're leaving money on the table.

And there are some remarkable statistics to back that idea up. For example, existing customers spend 67% more, on average, than new customers. That fact alone should tell you that retention should be a huge priority.

But there's more.

Acquiring a new customer can be up to 25 times more expensive than retaining an existing one. Think about that for a second. Let's say your average customer acquisition cost is $100. That means you might pay as little as $4 to keep an existing customer.

That's a monumental difference, and one that can significantly impact your bottom line.

Improving your retention efforts makes all of your other marketing and sales efforts more effective. A one-dollar increase in average transaction size might not feel like much. But if you increase retention so that hundreds or thousands of people are staying with your company long enough to make another purchase, that's going to make a big difference for your overall revenue.

With solid retention, every acquisition becomes more valuable. A small increase in average transaction value multiplies over time.

CLV Doesn't Work in Isolation

Like any other metric, you'll need to have more information to get the most out of monitoring your CLV.

For example, if your CLV goes up, you'll want to know why. Are customers buying more per transaction because your sales team has improved? Or are your retention efforts working better? Did your product team improve the profit margin?

And, of course, there are lots of other metrics that are important. Churn is especially important to monitor and improve. If you aren't keeping customers very long, you're going to have revenue problems.

You know better than anyone else which metrics are most important to your company, so you'll have to make the decision on which ones to prioritize. But no matter what you decide to keep a close eye on, be sure to emphasize taking quick action to maximize your CLV.

Remember That Value Isn't Just Monetary

In a 2017 Harvard Business Review article, Michael Schrage makes an interesting point about CLV that bears repeating here. Put simply, the value that your customers generate for your company isn't just monetary.

Here are some examples that Schrage gives in the article. "Our customers become much more valuable when…

- they give us good ideas

- they evangelize for us on social media

- they reduce our costs

- they collaborate with us

- they try our new products

- they introduce us to their customers

- they share their data with us"

As you can see, customers create value in many ways. Considering the ways your customers create value beyond their purchases tends to open up a lot of creative space. By tracking your company’s CLV you can learn how to improve your bottom line and get an accurate picture of your performance and growth.