When you start a business, you often start small without thinking about the bigger picture. Things like taxes, types of business structures, liabilities, and more aren’t at the top of your mind then.

However, these are essential factors that you need to take into account when you’re starting your business.

The reason here is that they can shape the path that your business will take and may make certain things easy or difficult.

With that in mind, let’s take a look at the various types of business structures available and how you can choose the right one for your business.

Types of Business Structures

Here are the main types of business structures that you can choose from as a business owner.

1. Sole Proprietorship

Sole Proprietorship is a business structure that doesn’t create a legal entity of its own. Instead, you can start running your business under your name as a Sole Proprietor.

You could also choose to give it a different name by filing for a DBA (Doing Business As).

This business structure is easiest to form and manage. All the income is passed through to your personal income tax return too.

2. Limited Liability Company (LLC)

This business structure combines the best elements of Corporations, Partnerships, and Sole Proprietorships. You can start your LLC business as a single owner or partner with others.

Additionally, you’ve got limited liability as the debt of the business doesn't become your personal liability. Finally, the income of the business passes through to your personal income tax return too.

3. Partnership

Partnerships are business entities that you can start when you’ve got multiple business partners.

However, just like a Sole Proprietorship, it’s not a legal entity. It’s not a very complex entity to start and the profits and losses are divided between the partners based on their holding in the business.

Just like Sole Proprietorships, the income from the Partnership firm passes through to the owners and there’s no real liability protection.

4. Corporation

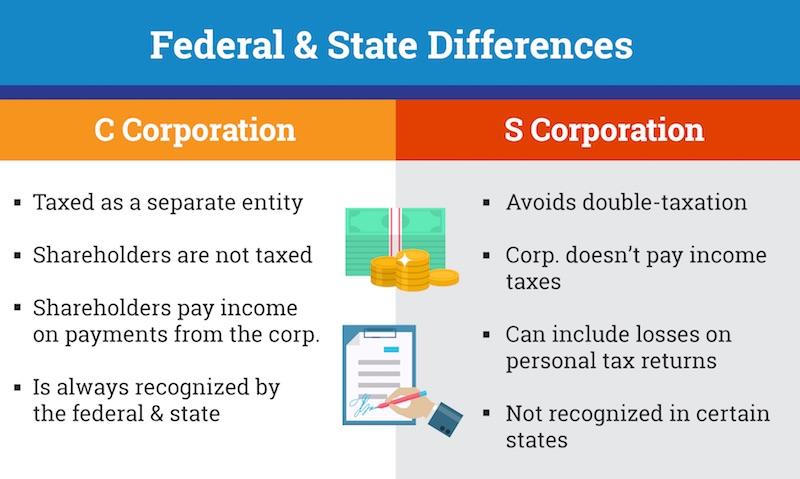

Corporations come in two forms — S-Corporations and C-Corporations. By default, every Corporation is a C-Corporation and it’s a legal entity that allows you to establish a well-structured business.

Image via Pay Tech

With a Corporation, you’re protected from liability and can also expand your business as it’s easy to raise funds, go public, and give shares to employees.

However, you’re subject to double taxation as each shareholder (owner) pays personal income tax and the business pays corporate taxes.

S-Corporations can help avoid this double taxation issue by allowing profits to pass through to the shareholders. However, you can only have up to 100 shareholders in these Corporations.

How to Choose Your Business Structure

Now that you’ve got an idea of the types of business structures, let’s take a look at how you can choose the right one for your business.

1. Ease of Formation and Management

The first question you need to ask yourself is — how complicated do I want my business to be?

In terms of complexity, Sole Proprietorships and Partnerships are the easiest to form and manage. As mentioned earlier, you can start your business as a Sole Proprietor with minimal requirements.

LLCs are slightly more complicated as they’re legal entities. However, Corporations are the most complicated among the lot. They’re challenging to form and have loads of legal and filing requirements. You’re also required to conduct annual meetings when you run a Corporation.

2. Liability Protection

Liabilities can arise at any point when you’re running a business. And if your business is a high-risk one, these liabilities could be pretty significant too. In such a situation, it’s important to consider if your business entity protects your personal assets or not.

LLCs and Corporations both offer liability protection. As a result, your personal assets would be shielded from any debt that arises from the business.

On the other hand, Sole Proprietorships and Partnerships don’t offer any liability protection. Which leaves your personal assets vulnerable. That’s why it’s recommended that you run only low-risk businesses when you opt for a Sole Proprietorship or Partnership.

3. Taxation

Taxation is yet another factor you need to consider while choosing between the types of business structures.

Sole Proprietorships, LLCs, S-Corporations, and Partnerships offer easy taxation with the pass-through taxation feature.

However, in the case of Sole Proprietorships, LLCs, and Partnerships, you would be subjected to the self-employment tax.

You can avoid this in the case of LLCs by choosing to get taxed as an S-Corporation.

However, C-Corporations are subject to double taxation. As a result, your tax outgo might be much higher in this case.

4. Going Public

If you want to raise funds by going public or find venture capitalists, there’s no better way than by opting for C-Corporations.

The reason here is that there’s virtually no cap on the number of shareholders a C-Corporation can have.

This makes it easy for you to distribute the company’s shares among your employees, investors, and even the public. Additionally, anyone can own these shares, including business entities and non-US citizens.

This isn’t possible in the case of other types of business structures.

5. Number of Owners

Sole Proprietorships, as the name suggests, can only have one owner who has to be an individual. So, if you’ve got more than one business owner, you’d have to opt for other types of business structures — all of which allow multiple owners.

Also, in the case of S-Corporations, those owners need to be US citizens. Additionally, there’s a cap of 100 shareholders in this case.

However, LLCs and C-Corporations allow foreign nationals and other entities to own the business too and there’s no limit on the number of owners.

Final Thoughts

It’s critical that you choose the right business structure for your organization to ensure that you’re able to put it on the right growth path.

By carefully analyzing these business structure types against the given factors, you can understand which one works the best for you.

If you’ve got any questions about the types of business structures mentioned above, ask them in the comments.